Financial consulting is evolving rapidly with technological advancements, regulatory changes, and shifting client expectations. This blog explores key trends like AI-driven financial analysis, blockchain integration, and ESG (Environmental, Social, and Governance) investments that are shaping the future of financial consulting.

1.AI and Automation in Financial Advisory

AI is transforming financial consulting through better decision making, automatization of mundane tasks, and greater insights gained through data analysis. Machine learning algorithms are increasingly being utilized to determine risk, identify fraud, and provide customized financial recommendations. Virtual assistants and chatbots powered by AI are enhancing client communication, providing 24/7 support and efficacy. Consultants utilizing AI-based tools can provide more accurate and data-driven recommendations, ultimately leading to greater client trust and satisfaction.

2. Blockchain and Decentralized Finance (DeFi)

Blockchain continues to challenge the conventional financial framework. As decentralized finance (DeFi) increases in popularity, financial consultants are compelled to fit into new realities and challenges. Tokenization, digital assets, and smart contracts are revolutionizing investment plans and financial transactions. Blockchain promotes openness, minimizes scams, and cuts down operating expenses. Blockchain-based solutions integrated into financial consultancy services will become important for keeping pace in 2025.

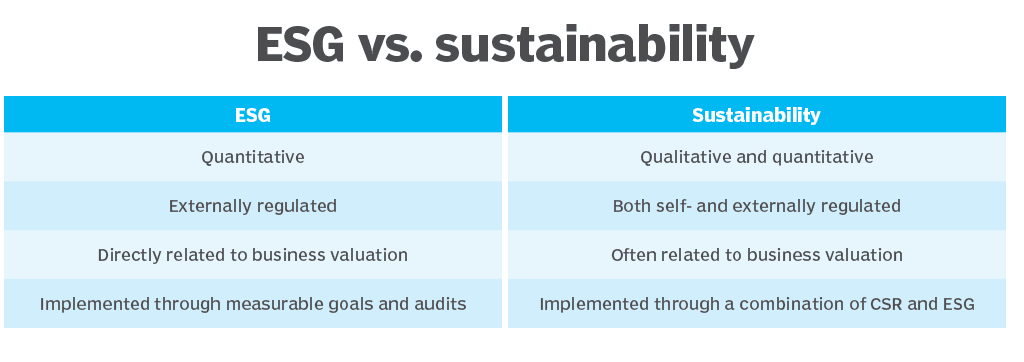

3. ESG Investments: A Growing Priority

ESG investments are becoming increasingly popular as investors seek to focus on sustainability and socially responsible business practices. Financial advisors now need to include ESG considerations in their advisory services to enable clients to match their investments with social responsibility objectives. Strong ESG-performing companies will be sought after by investors, rendering sustainability-oriented consulting a significant financial service feature of 2025.

4. Fintech Integration and Digital Transformation

The fintech era is speeding up digital transformation in financial consultancy. Cloud computing platforms, robo-advisors, and automated portfolio management systems are transforming the financial consultant’s landscape. Fintech products allow smooth transactions, instant financial planning, and enhanced risk management. Consultants need to keep themselves abreast of current fintech trends in order to offer clients innovative financial services and remain ahead of the competition.

5. Regulatory Changes and Compliance Challenges

With the advancement of financial technologies, regulatory agencies globally are enacting new policies to protect investors and ensure financial stability. Adhering to new regulations, including data protection policies and digital asset regulations, will be a prime concern for financial consultants. Remaining updated with the latest regulatory requirements and using compliance technology will be critical in maintaining ethical and lawful financial consulting services in 2025.

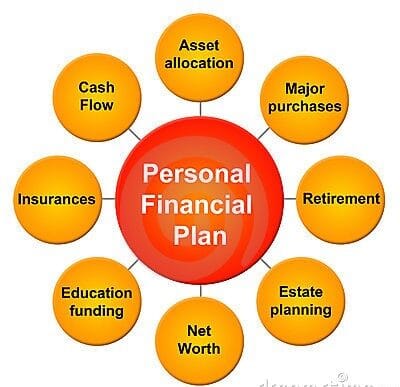

6. Personalized Financial Advisory and Planning Services

As AI and big data analytics continue to advance, financial consulting is more personalized than ever before. Clients anticipate customized financial plans based on their individual goals, risk tolerance, and market situation. Hyper-personalized financial advisory services, supported by predictive analytics, will be a norm in 2025, enabling consultants to offer customized solutions that meet clients’ financial objectives.

Conclusion

The future of financial consulting in 2025 is influenced by technological advancement, sustainable investment, and changing regulatory environments. Financial consultants have to adopt AI, blockchain, ESG investing, and fintech innovations to survive. By keeping pace with these trends, financial professionals can improve client experiences, maximize investment plans,and steer the changing financial environment successfully. The secret to success in the future of financial consulting is adaptability, innovation, and a focus on providing value-driven financial solutions.